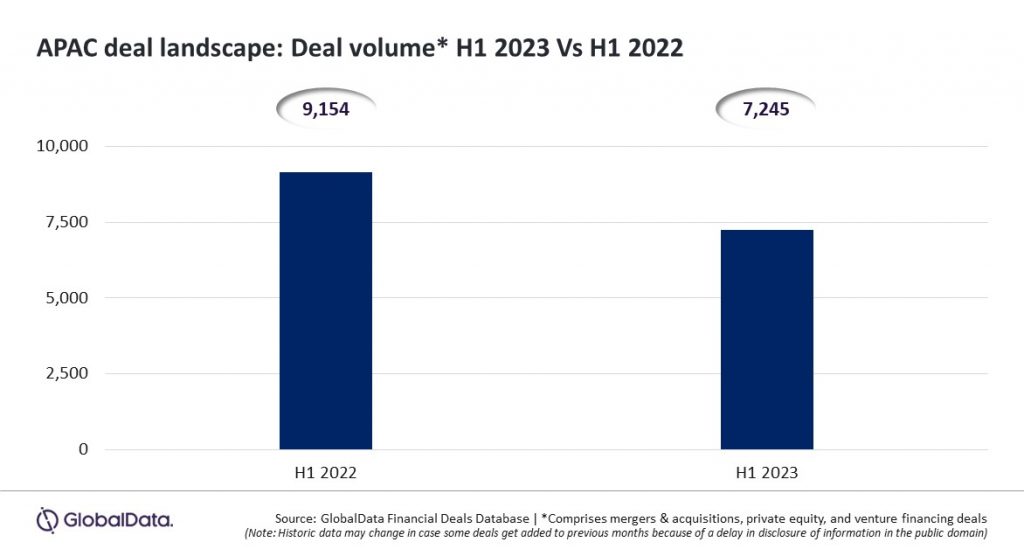

Media Release by GlobalDada; A total of 7,245 deals (mergers & acquisitions (M&A), private equity, and venture financing deals) were announced in the Asia-Pacific (APAC) region during the first half (H1) of 2023, which was a decline of 20.9% over 9,154 deals announced during the same period in 2022, reveals GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database revealed that all the deal types under coverage witnessed year-on-year (YoY) decline in deal volume in H1 2023. The numbers of mergers and acquisitions, private equity and venture financing deals declined by 10.8%, 8.1% and 29.4%, respectively, during H1 2023 compared to H1 2022.

deal volume in H1 2023. The numbers of mergers and acquisitions, private equity and venture financing deals declined by 10.8%, 8.1% and 29.4%, respectively, during H1 2023 compared to H1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Owing to factors such as rising interest rates, high inflation, fear of recession and geopolitical tensions, deal activity has remained sluggish globally in 2023 so far and the APAC region is not an exception to this global trend.”

In fact, most of the key markets within the APAC region experienced double-digit decline in deals volume in H1 2023 compared to H1 2022. For instance, China, which is the top APAC market, witnessed a YoY 11.6% decline in deals volume in H1 2023.

Other key APAC markets such as India, Japan, Australia, South Korea, Singapore, Hong Kong, Indonesia and New Zealand also witnessed year-on-year decline in deal volume by 31.4%, 14.3%, 22.4%, 37.5%, 23.5%, 23.7%, 43.7% and 28.4%, respectively, during H1 2023 compared to H1 2022.

Ends