China-Led Infrastructure Bank set to start work before end of 2015

Twenty-one Asian countries have signed an intergovernmental memorandum of understanding for establishing a new multilateral bank to finance infrastructure projects in Asia. The Asian bank, proposed by China, would be tasked with funding regional infrastructure projects and would galvanize growth in rising Asia.

The representatives were from Bangladesh, Brunei, Cambodia, China, India, Kazakhstan, Kuwait, Laos, Malaysia, Mongolia, Myanmar, Nepal, Oman, Pakistan, the Philippines, Qatar, Singapore, Sri Lanka, Thailand, Uzbekistan and Vietnam.

The memorandum specifies that the authorized capital of the AIIB is $100 billion and the initial capital is expected to be around $50 billion. The paid-in ratio will be 20 percent. Beijing will be the host city for the AIIB’s headquarters. It is expected that the prospective founding members will complete the signing and ratification of the Articles of Agreement in 2015 and the AIIB will be formally established by the end of 2015.

The signatory nations will take part in negotiations on the new bank’s Articles of Agreement. Countries that sign and ratify the articles will officially become founding members of the bank.

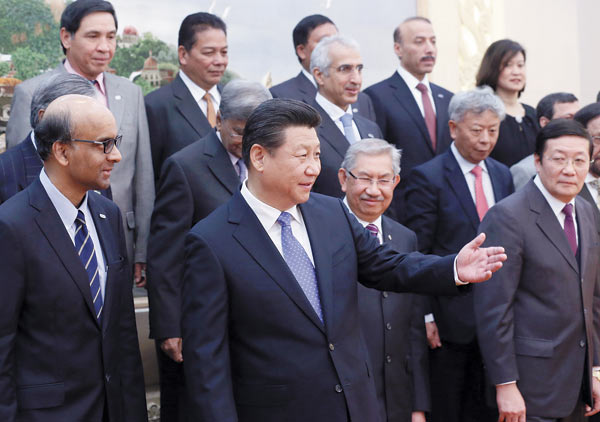

According to a Xinhua Report Chinese President Xi Jinping look forward to better global financial governance as 21 countries signed a memorandum of understanding (MOU) at the Great Hall of the People in Beijing. Congratulating the representatives on inking the memorandum, the Chinese President said it reflects all the parties’ aspiration, determination and action for unity and cooperation in pursuit of common development.

“(The establishment of the AIIB) will help to improve global financial governance, which is very meaningful,” Xi said, adding that he hopes all sides concerned will make concerted efforts to make the AIIB a financing platform of infrastructure construction featuring equality, inclusiveness and high efficiency, and multilateral development bank that meets the demand of all countries in the region.

“To become rich, you need to build roads first,” President Xi said quoting a Chinese saying. AIIB should focus on boosting inter-connectivity of infrastructure and economic cooperation in the region to inject new driving forces into the economic development in Asia.

In October last year, President Xi Jinping put forward a proposal on setting up the bank. Since then, five rounds of talks with countries interested in the proposal have been held on establishing the multilateral lender and achieving its reported capital target of $100 billion.

China Daily termed the agreement of setting up the Asia Infrastructure Investment Bank “a milestone”. But observers are disappointed by the absence of some major economies, such as Japan, Australia, South Korea and Indonesia, at the launch of Asian infrastructure bank. Australia and South Korea had previously expressed their interest in joining the bank. However, this does not rule out the possibility that they will join later. The absence of some major economies underscores the difficulty China faces as an emerging power in making global governance initiatives.

Despite the progress made, the bank is seen as a challenge to the World Bank and Asian Development Bank, both multilateral lenders that count Washington and its allies as their biggest financial backers.

According to Western media, the Asian Infrastructure Investment Bank (AIIB) is to rival the World Bank and the Asian Development Bank (ADB). In reality, the idea of the AIIB was put forward more than a year ago; not to undermine either the World Bank or the ADB, but to deliver the promise that both have failed to deliver – sustained growth in emerging Asia, notes Dan Steinbock, Research Director of International Business at India China and America Institute (USA) in his article published in EconoMonitor.

Finance Minister Lou Jiwei has said that the planned start-up capital is $50 billion, with China set to be the largest shareholder, with a stake of up to 50 percent. Each nation’s stake has been generally allocated according to its GDP.

The Australian Financial Review reported on Friday that US Secretary of State John Kerry had personally asked Australian Prime Minister Tony Abbott to keep Australia out of the AIIB.

However according to news reports, US State Department spokeswoman Jen Psaki said, “Secretary Kerry has made clear directly to the Chinese as well as to other partners that we welcome the idea of an infrastructure bank for Asia but we strongly urge that it meet international standards of governance and transparency.

Chinese officials, including Finance Minister Lou, have said repeatedly that the bank will not compromise on standards. They have also made it clear that it will complement, rather than rival, established organizations such as the World Bank and Asian Development Bank.

Takehiko Nakao, president of the Asian Development Bank, said that setting up the new bank is “understandable” because regional financing requirements for infrastructure are considerable. “If it’s established, we’re prepared to consider cooperating with the new bank,” Nakao said.

World Bank President Jim Yong Kim has said that the World bank welcomes the AIIB and that the two banks should be complementary partners rather than competitors. He said in July that estimates for infrastructure needs in developing countries are at least $1 trillion annually, far beyond the current capacity of his institution and private investment to handle. “We think that the need for new investments in infrastructure is massive and we think that we can work very well and cooperatively with any of these new banks once they become a reality,” Kim told reporters in Beijing.

Chen Fengying, director of the Institute of World Economic Studies at the China Institutes of Contemporary International Relations, said, “It is naturally difficult for China, as an emerging power, to do something that is considered a challenge to the No 1 power. But despite controversy, China has to do its part and come up with concrete results. I believe such results will persuade more countries to join.”