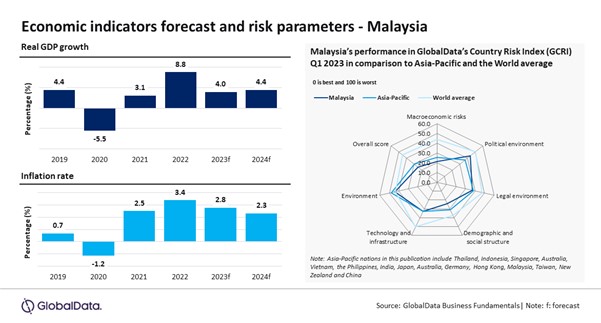

Media Release by Global Data, 20 June 2023; Malaysia’s economic growth in 2023 is predicted to be fuelled by easing inflationary pressure, a stronger job market, and solid growth in private consumption. Nevertheless, weak external demand poses a downside risk that could affect trade prospects. Against this backdrop, Malaysia’s economic growth is set to reach 4% in 2023, surpassing the average growth of 3.1% observed during the previous five years (2018-22), forecasts GlobalData, a leading data and analytics company.

GlobalData’s latest PESTLE Insights report, “Macroeconomic Outlook: Malaysia,” reveals that Malaysia’s economy began 2023 on a strong note with the real GDP expanding by 5.6% on an annual basis in Q1 2023, higher compared to 4.8% growth recorded in Q1 2022.

The growth in Q1 2023 was broad based with the services and manufacturing sectors growing by 7.3% and 3.2%, respectively. The unemployment rate remained low at 3.5% in Q1 2023 (3.6% in Q4 2022). Inflation moderated to 3.6% in Q1 2023 from 3.9% in the previous quarter, supported by government measures and consumer subsidies.

GlobalData forecasts the inflation rate in 2023 to decrease to 2.8% compared to 3.4% in 2022. Additionally, the real household consumption expenditure is expected to grow by 4% in 2023, surpassing the average growth of 2.7% recorded in the last five years (2018-22).

Maheshwari Bandari, Economic Research Analyst at GlobalData, comments: “Malaysia, a key producer and exporter of oil and gas and semiconductors, is expected to maintain a goods trade surplus in 2023 due to rising demand for LNG and semiconductors. However, the services trade may slow down, leading to a widening deficit.

“Meanwhile, logistical disruptions caused by floods in the beginning months of 2023 and poor-quality fruit due to older palm trees are tightening the palm oil market, raising concerns about higher food costs. Additionally, the shift from La Nina to El Nino weather patterns may further affect palm oil production, resulting in smaller fruit bunches with lower oil content.”

Sector-wise, mining, manufacturing, and utilities activities contributed 34.3% to the gross value added (GVA) of Malaysia in 2022, followed by wholesale, retail and hotels (17.7%), and transport, storage and communications (10.9%). These sectors are expected to grow by 7.2%, 8.7% and 9.8%, respectively, in 2023.

The Ministry of International Trade and Industry (MITI) in Malaysia plans to review the New Industrial Master Plan 2030 (NIMP 2030) to support the industrial development and foster collaboration between policies and industries. This is expected to drive the manufacturing sector growth in Malaysia, which GlobalData projects to expand at an average annual rate of 6.8% during 2023-25.

Malaysia has allocated MYR400 billion ($90.9 billion) for infrastructure development as part of the 12th Malaysia Plan (2021-25), which is expected to drive the construction and allied sectors growth. The sector is projected to grow by an average annual rate of 7.5% during 2023-25.

Malaysia is categorized as a very low-risk nation and ranked 21st out of 153 nations in GlobalData Country Risk Index (GCRI Q1 2023). The country’s risk score is lower in the parameters of macroeconomic risk, legal, and technology and infrastructure, demographic and social and environment risk, when compared to the average of Asia-Pacific nations.

Maheshwari concludes: “Despite the external challenges, the Malaysian economy is expected to remain resilient, supported by strong economic fundamentals and the implementation of measures to sustain growth, promote governance reforms, and ensure social justice as outlined in Budget 2023. These initiatives are anticipated to bolster the economy and help overcome potential obstacles on the external front.”

ENDS